Hong Kong is well known as a strategic location in Asia, one of the top financial hubs with free trade policies. While setting up the Hong Kong company is relatively quick and straightforward, maintaining the company’s legal status involves fulfilling certain annual compliance requirements. These obligations, mandated by law, must ensure timely delivery of statutory returns to Companies Registry (CR) and the Inland Revenue Department (IRD). Adhering to these requirements is essential to ensure that the company remains compliant and in good standing. Let’s find out with LNT Consulting.

Annual Compliance Filing to Companies Registry (CR)

Business Registration Certificate Renewal

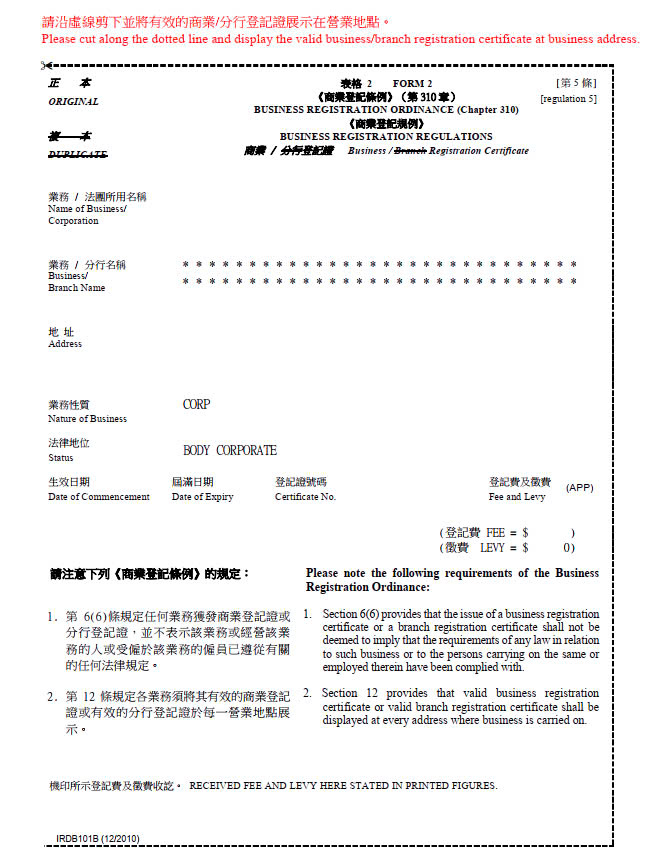

The business registration certificate in Hong Kong will be valid for one year or 3 years, and it must be renewed within 1 month before the expiration date.

Sample of the Hong Kong Business Registration Certificate issued by Companies Registry

Failure to renew the business registration certificate on time can lead to various penalties, including but not limited to:

- HKD 300 (1 year renewal)

- HKD 900 (3 year renewal)

- Court proceedings

- Business deregistration

Annual Return Filing (NAR1)

Annual return, also known as Form NAR1, is the record about the Hong Kong company information, provides key information about the company particulars such as director, shareholder and company secretary, registered address, and a summary of the company’s operations.

A private limited company must submit its annual return to the Companies Registry within 42 days since the anniversary incorporation date. In case you are not sure about the deadline for your annual return, please use the https://www.cr.gov.hk/en/compliance/annual-return/calculator.htm to calculate the due date.

For instance: If your company has been incorporated on 1st Jan 2023, the due date for annual return filing will be 12th Feb 2024.

There are 2 primary methods to file an annual return – Electronic or physical delivery. It’s unable to extend the deadline for annual return delivery. Failure to deliver the annual return filing on time is a criminal offense, companies must pay the higher registration fees for late filing or are liable to prosecution.

Notification of changes of company particulars

Any changes in a Hong Kong company must be notified to the CR on time to avoid the penalty fee. The changes are included but not limited to:

- Change of Hong Kong registered office address

- Change of company secretary

- Change of directors and shareholder’s information

- Change of business nature

- Change of company name

It’s compulsory to submit the specific forms for changes to the Companies Registry within 1 month since the respective change. Failure to comply with this provision leads to default, commit an offense, fine or prosecution.

Annual General Meeting (AGM)

Annual general meeting is the mandatory requirements for Hong Kong company, provides the voting rights for shareholders to:

- Review the company’s performance.

- Discuss significant matters.

- Maintain or select the new directors.

- Approve the financial statements and appoint the auditors.

The Hong Kong company is not required to hold an AGM if it falls under the following circumstances:

- Everything required in the meeting is done by a written resolution.

- Company has a sole member.

- A written resolution for AGM is passed by all company members.

- A dormant company (not carry out any kind of business activity or receive incomes).

A Private Limited Company that has the first financial year end longer than 12 months must hold its first AGM within:

- 9 months after the anniversary incorporation date;

- OR 3 months after the financial year ends.

From the second year onwards, the Hong Kong registered company must hold the AGM within 9 months after the end of its accounting reference period. Failing to hold an AGM as required can result in penalties and regulatory actions from the Companies Registry

Annual Compliance Filing to Inland Revenue Department (IRD)

Audited Financial Statements (Audited FS)

Unlike Singapore, auditing the financial statement is exempted for SMEs. But for the registered Hong Kong companies, it’s a compulsory requirement, regardless of size of the business.

Certain documents will be required to prepare the financial statement:

- Sale Invoices and Receipts

- Vouchers

- Payment slip

- Bank statement

- Expenses invoice and receipt

- Tangible assets record

- Inventory checklist (quantity and unit cost of each item)

- Contact for investments

- Others

The financial statement is the report that compile the business financial activity and health for the preceding year, including:

- A balance sheet: An overview of liability, asset and shareholder’s equity.

- Profit and loss account: Summarize revenue and expenses during a specific period.

- A cash flow statement: Track the cash flow of business, how to use cash to pay debts, contribute to operating activities and funds for investments.

The business must appoint a certified public accountant to audit the financial statement on behalf of the company. They must be a licensed 3rd independent party who is assigned to provide financial accountability and accuracy for stakeholders.

The Hong Kong company must submit the unaudited financial statement along with the profit tax return (PTR) within 1 month after the date they receive the PTR issued by the IRD. Failure to submit the audited financial statements on time can result in penalties, fines or even legal action.

Profit Tax Return Filing

Every registered Hong Kong company must file the Profit Tax Return together with the tax computation and audited financial to IRD within 1 month after the date of PTR issuance. There are 3 forms of PTR:

- BIR51 – Corporations

- BIR52 – Person

- BIR54 – Non-Resident Persons

For the newly incorporated company, the first PTR is usually issued within 18 months. The IRD normally issues the PTR on the 1st working days of April every year.

The Profits Tax Return can be submitted electronically through the eTAX portal or physically by delivering a signed copy to the IRD’s office. Companies must ensure that all information is accurate and complete, as incomplete submissions can result in processing delays. Late submission of the Profits Tax Return can result in penalties, including fines or an estimated assessment by the IRD, which may be higher than the actual tax due. Repeated non-compliance may result in more severe actions, such as prosecution.

Employer’s Return Filing

Employers are required to file the Employer’s Return of Remuneration and Pensions (Form BIR56A and IR56B) IRD in Hong Kong. The form typically includes the income paid to their employees (salaries, wages, bonuses, pensions and other benefits). If the Hong Kong company does not hire any employee, the owner should file nil.

Usually, the IRD issues the Employer’s Return to employers on the first working day of April each year. Employers have one month from the date of issuance to complete and submit the return. Late filing or failure to file the Employer’s Return can result in penalties, including fines and potentially prosecution. Accurate reporting is essential, as providing false or misleading information can lead to severe legal consequences for the employer.

To summarize, maintaining compliance with the annual requirements for a Hong Kong company is crucial for ensuring smooth business operations and avoiding legal complications. By adhering to these obligations above, companies can safeguard their good standing with the authorities. A proactive approach to meeting these requirements not only helps avoid potential penalties but also demonstrates a commitment to transparency and proper governance. With LNT Consulting, staying up-to-date with compliance is a fundamental part of sustaining growth and trustworthiness in the market. If you’re not familiar with the local laws here, don’t worry, leave it to us.

Disclaimer: LNT Consulting aims to provide up-to-date and accurate information on this website. However, this information is intended for reference only and should not replace professional legal advice. For guidance on your specific case, please contact LNT’s customer service.